federal income tax return

Your household income location filing status and number of personal. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Solved According To The Irs Individuals Filing Federal Income Tax Returns Course Hero

100 Free Tax Filing.

. The income ranges the rates apply to are called tax brackets. Your bracket depends on your taxable income and filing status. These are the rates for.

Income tax from those payments the third -party pay er not the employer must report and remit the income tax withheld. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional. Gather the following information and have it handy.

Social security number SSN or Individual Taxpayer. 10 12 22 24 32 35 and 37. A federal tax return is a tax return you send to the IRS each year through Form 1040 US.

Already millions of taxpayers have been waiting four or five months for their federal income tax refunds after completing 1040 paper. On their 2023 return assuming there are no changes to their marital or vision status. As a result their 2022 standard deduction is 30100.

There are seven federal tax brackets for the 2022 tax year. Individual Income Tax Return. Follow these steps for tracking your 2021 federal income tax refund.

Using the IRS Wheres My Refund tool. Return must be filed January 5 - February 28 2018 at participating offices to qualify. 2021 tax preparation software.

June 22 2022 202 PM 10 min read. Low Income Taxpayer Clinics. Federal income tax rates range from 10 to 37 and kick in at specific income thresholds.

Efile your tax return directly to the IRS. Check Your Refund Status Online in English or Spanish Wheres My Refund. It shows how much money you earned in a tax year and how.

The Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals. For Wisconsin purposes the pay er of third- party sick pay who. Effective tax rate 172.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. This does not grant you. LMITO was boosted by 420 in the last federal budget handed down in March due to.

Viewing your IRS account. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The LMITO tax break was one of the casualties of Tuesdays budget.

Type of federal return filed is based on your personal. Prepare federal and state income taxes online. 25900 1400 1400 1400.

- One of IRSs most popular online features-gives you information about your federal income tax. Valid for 2017 personal income tax return only. If you cant file your federal income tax return by the due date you may be able to get a six-month extension from the Internal Revenue Service IRS.

The Federal Government Has Extended Federal Income Tax Deadlines Will Ohio Cleveland Com

Tax Refund Check Hi Res Stock Photography And Images Alamy

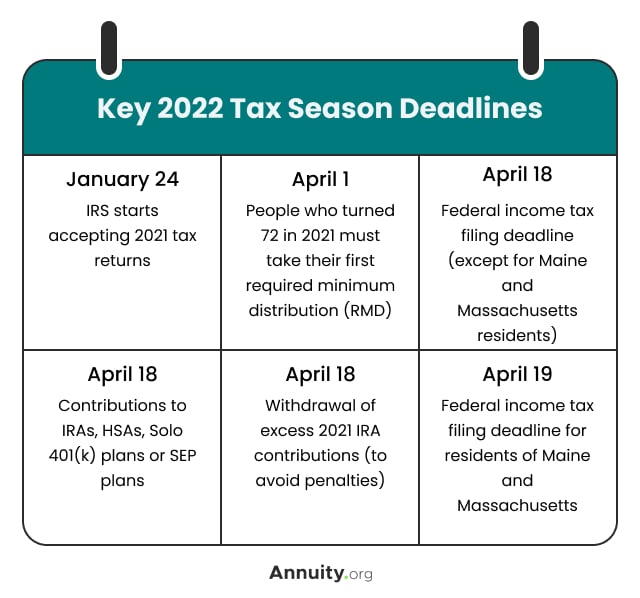

2022 Filing Taxes Guide Everything You Need To Know

Where S My Refund Track My Income Tax Refund Status H R Block

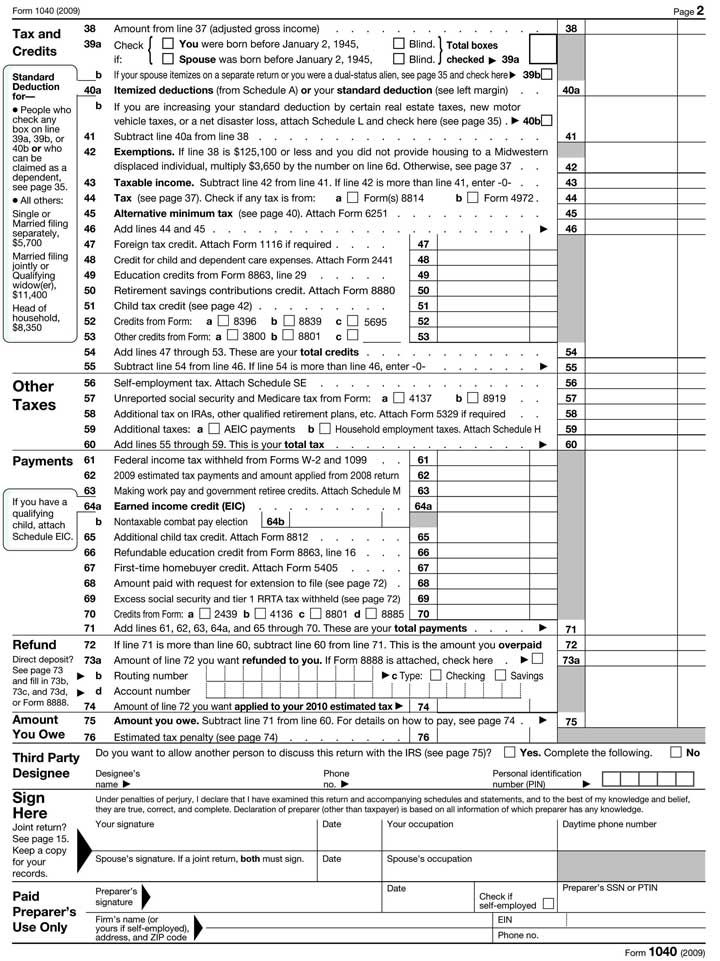

3 21 3 Individual Income Tax Returns Internal Revenue Service

Obama S 2012 Effective Tax Rate Was 18 4 Percent Now What Do Your Members Of Congress Pay In Taxes Don T Mess With Taxes

The U S Federal Income Tax Process

Q 56 When Is The Last Day You Can Send In Federal Income Tax Forms

Federal Income Tax News Gray Tolub

Reforming Federal Income Tax The Regulatory Review

How To Calculate Your Federal Income Tax Refund Tax Rates Org

How To Track Tax Refunds And Irs Stimulus Check Status Money

2020 Taxes Everything You Need To Know About Filing This Year

When To Expect Your 2022 Irs Income Tax Refund

New In 2020 Changes To Federal Income Tax Withholding Tilson

2018 Irs Federal Income Tax Brackets Breakdown Example Single My Money Blog